Crypto Valley Venture Capital (CV VC) report South Africa as amongst biggest Blockchain markets in Africa

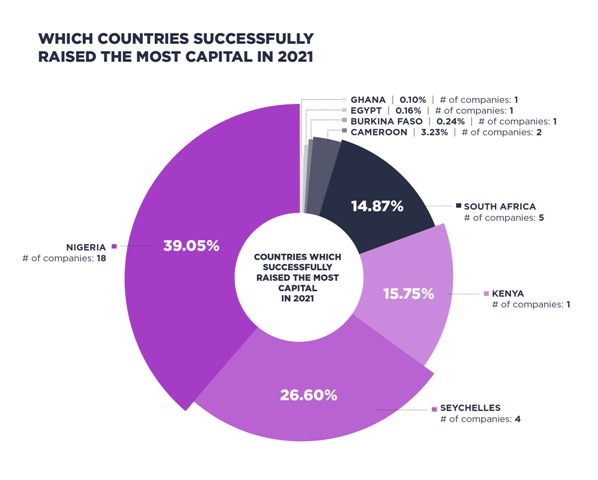

The inaugural African Blockchain Report, published by CV VC in collaboration with Standard Bank, revealed South Africa to be amongst the top fundraisers for new blockchain ventures in Africa in 2021, with US$18.89 million raised to fund five blockchain and cryptocurrency companies. This was still behind Nigeria, which raised $49.6 million for 18 companies, Seychelles ($33.8million for 4 companies) and Kenya at ($20 million for one enterprise).

CV VC, an initiator of Crypto Valley – the world’s most mature blockchain hub, with an enviable regulatory landscape and 14 blockchain Unicorns – published the inaugural report as part of the Blockchain Hub Conference taking place in Davos Switzerland. The report provides a compelling structural overview of the emerging blockchain sector and insights regarding funding in Africa.

“As the largest bank in Africa, Standard Bank has embarked on a journey to evolve beyond bank to become a digitally-enabled platform business,” says Ian Putter, Standard Bank’s Head of Blockchain and Centre of Excellence. “South Africa has the most sophisticated financial sector on the African continent. Although some may believe the country is in a state of regulatory uncertainty, this is by no means the case and we are integrating cryptocurrencies into our economy and society by building regulatory frameworks, developing CBDCs, and actively participating in the blockchain community.

“Although initially cautious in their approach, South African regulators have been working hard to embrace new-age technologies and create a transparent regulatory environment that will further encourage its fast-paced blockchain and cryptocurrency adoption. For Standard Bank, the blockchain offers a powerful platform on which to deliver innovative services more efficiently to help our client’s greatest problem,” Putter says.

The report shows in detail how Africa has self-accelerated blockchain as a transformative force for society and the economy and how pioneers continue to reinforce the need for more unified action on regulation and infrastructure.

It also shows how funding far outpaced all other sectors, eleven times. The findings demonstrate how nations and stakeholder capitalists are beginning to step in and embrace Africa’s self-determining participation in the fourth industrial revolution.

While it is a fact that African nations are amongst the fastest crypto adopters globally, today’s CV VC report moves past crypto. It looks at the underlying revolutionary blockchain movement, set to enable Africa to transact and interact for the well-being of its people and economies.

- Companies raised $91 million in Q1 of 2022, a staggering 1,668% YoY increase from Q1 of the previous year.

- When comparing Q1 2021 vs. Q1 2022, venture funding for African blockchain startups far outpaces the growth seen in general African venture funding – 1,668% vs. 149% – showing 11 times the level of growth on a YoY basis.

- Africa is the fastest adopting crypto continent globally, yet it has only a 0.5% share of total global blockchain venture funding, which stands at $25.2 billion.

- African blockchain funding of $127 million in all of 2021 is similar in size to a single blockchain ‘mega-deal’ of which there were 59 globally.

- The regulatory quagmire is clearing as 6 nations have regulated, and others are making headway.

- Blockchain in Africa is unique as it is driving from the bottom up, where essential industries are propelling forward with blockchain tech; agriculture, mining, remittances, inclusion, identity, and property, to name a few.

The African continent is emerging as a vibrant technology investment location. Sharp minds are driving valuable developments, and investment capital is seeping in, albeit still smaller than the rest of the world. Capital is being invested, despite the waters of conventional deal funnels being muddy caused by a lack of available data for potential funders – especially international ones. The report successfully depicts a unique holistic overview of blockchain in Africa, which will facilitate funders to make a better judgment of Africa’s investment potential.

Most notable in the report is the evidence of the brilliant mindset, energy, and tech capability of the many great founders who are leading the African blockchain revolution in a manner that is exemplary to the rest of the world.

“While actively participating in Africa, we are amazed and humbled by the determination of the brilliant founders who are changing the future not just for their industries and nation but for the world. In Africa, there is a mindset that complements Switzerland’s determination and a will to create well-being for its citizens and the future of humanity. As the world enters the decade of the fourth industrial revolution, building on blockchain as a transformative tech, it is worth recanting the main theme of this year’s WEF, ‘Working Together and Restoring Trust’. This is what CV VC intends to do with other drivers in Africa,” said Mathias Ruch, Co-Founder of CV VC.

Concluding today’s launch of The Blockchain Africa Report, Putter of Standard Bank Group, the largest African bank by assets, said, ”Africa matters. Africa is a reminder that life matters and that there is a great need for everyone to work together to enable humanity to be well in all ways. The immediacy of existential threats as experienced by Africans requires a different pace. Africa’s difficulties are compounded by the pandemic that has disrupted revenues, foreign direct investment, development assistance, remittances, trade, and tourism, and not forgetting the effects of war. African economies are in danger of even further marginalization due to macro trends towards economic deglobalization. The silver lining has been the self-fast-tracking of Africa’s digital and tech economy. This has already bolstered resilience as a road map to how and why the world needs to embrace blockchain as a transformative technology. Standard Bank has been a pioneer in leveraging blockchain to bring speed and transparency to our customer base across Africa. We are very excited to work with CV VC as a blockchain ambassador to enable the further emergence of blockchain, as a resource on which Africa can build and outreach globally”.

As a blockchain investor and builder of international startup ecosystems, CV VC’s intention with the report is to lend its renowned expertise to enable Africa, the world’s second-largest continent in both size and population to achieve its true potential. They are committed to investing in the broader applicability of blockchain to solving problems and creating new markets beyond crypto.

CV VC has a proficient team on the ground, including Gideon Greaves, who today said that “As a Swiss headquartered company, CV VC holds great value in precision and knowledge sharing as drivers of innovation. Our objective with the African Blockchain Report is to share a data-driven account of blockchain in Africa and begin an annual collation of benchmarkable venture data and solidly referenced African insights. We focussed the report on a data set of 40 African blockchain companies. This way, we can be sure of the relevance of facts from which we can benchmark forward. We are also very proud to give an assessment of the regulatory landscape and a magnetic introduction to some of the greatest blockchain minds on the continent”.