By Olivier Granet, Managing Partner and Chief Executive Officer for Kasada Capital Management

While Africa still accounts for relatively few Covid-19 deaths compared to the rest of the world, the economic impacts of the pandemic on the continent continue to grow. GDP growth for the continent has been slashed as governments across the globe implement harsh containment measures including international travel bans. In addition, most African governments lack the fiscal capacity to protect businesses and entrepreneurs through stimulus packages as they have in developed nations, such as the U.S. and Europe.

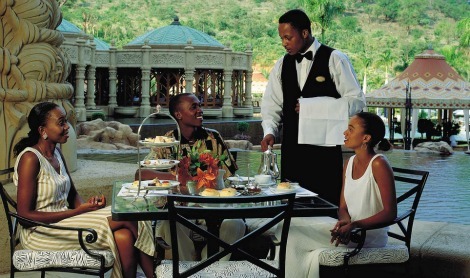

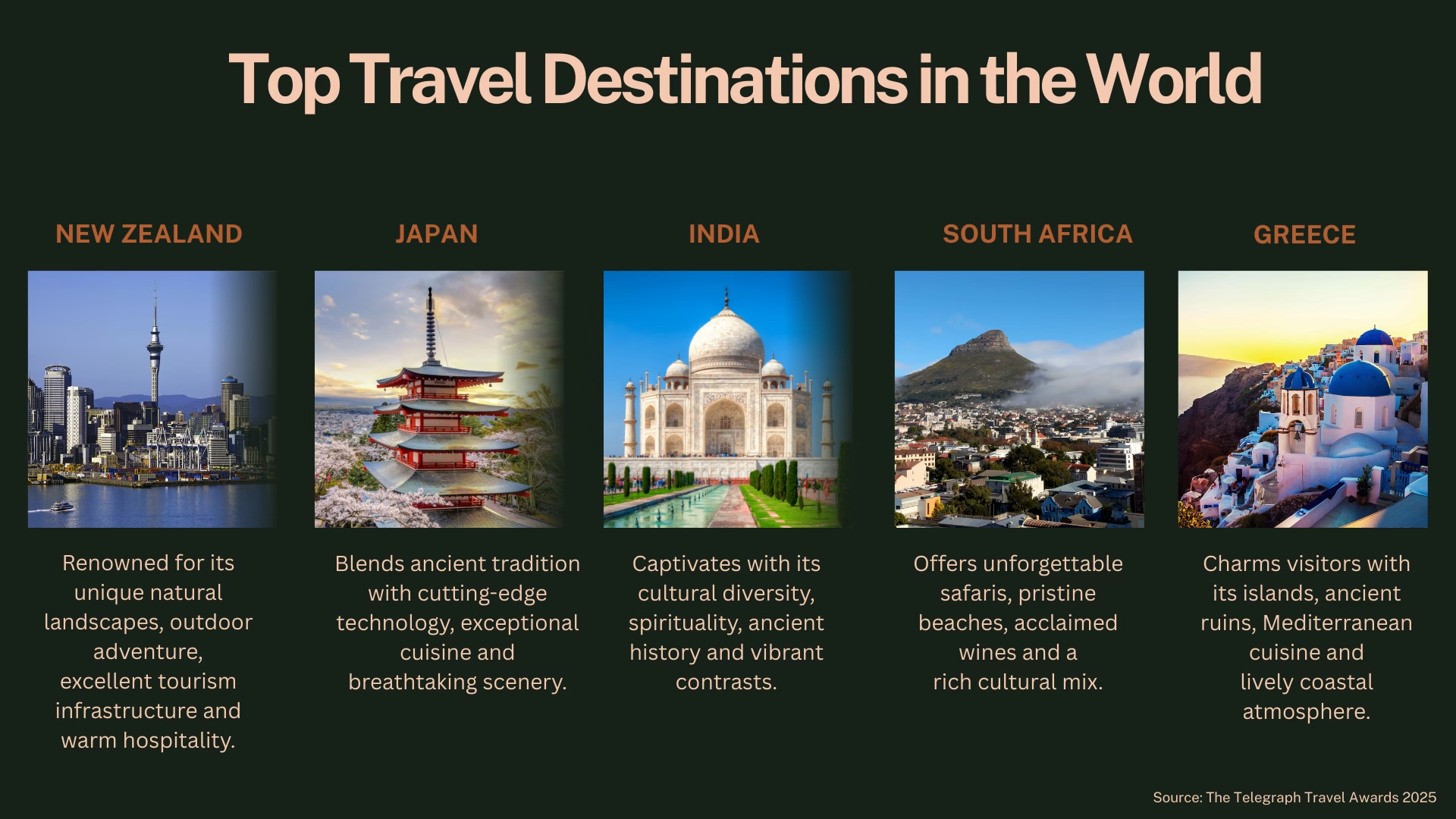

One of the worst hit industries in Africa is the tourism and hospitality sector, one of the most significant contributors to the continent’s economic and social growth. Prior to Covid-19, the continent attracted 70m tourist arrivals in 2019, generating more than US$38bn. The sector employs about 25 million people across the Continent. Travel and tourism accounts for one in five of all new jobs created worldwide for the last five years.

The fall-out from Covid-19 looks set to change this picture dramatically over the mid to long-term.

Moreover, sub-Saharan Africa’s hospitality sector is highly fragmented with many small players, often operating just a few assets each. In challenging times, this factor compresses the availability and affordability of capital as most hotel owners simply do not have the capacity to weather the storm. Lack of available financing was already one of the most important challenges for the hospitality industry in Africa prior to the Covid-19 crisis.

Over the longer-term, the question turns to how finance can be found to lead an eventual rehabilitation of Africa’s hospitality sector and job preservation. There is no doubt that it will emerge looking very different from when it entered the Covid-19 crisis. Rigorous constraints in terms of how people can travel will last a significant period of time both domestically and cross border, adding further pressure. Traditional funding lines are likely to be harder to come by as the continent’s banks try to stabilise and aid recovery across multiple sectors. Private investors have their own cash constraints, and many are in fundraising mode rather than focussing on deployment.

So how can Africa afford to weather this storm?

It is important that development finance institutions, such as the International Finance Corporation, Proparco and regional development banks identify the hospitality sector as a key role player in the continent’s economic recovery. This is a critical time for the private sector to invest in the sector too and work closely with financial institutions.

Now is the time for African governments to work with these funding partners to stimulate the sector in a post-Covid-19 world. This requires a new way of working and a different kind of corporation – with DFIs, African banks, private sector and governments bringing together their sector specialists to find collective solutions. This should not be limited to the physical assets of hotels at the end of the value chain, but provide a catalyst to capacity building throughout, to addressing infrastructure and education requirements that can help create a platform for the sector to thrive.

More than ever, it is vital to have a coordinated approach as Covid-19 changes the way people travel. From the airport check-ins, through to “new safety and hygiene norms” within hotels to mitigate physical contact, this will influence and provide travellers’ with a whole new experience.